Sundry Pictures

The house growth business has passed through super expansion during the last two years. In 2020, many invested in domestic upgrades as extra other folks had been at domestic and had extra important private financial savings. This pattern ended in a growth in lots of domestic growth and development outlets similar to The House Depot (NYSE:HD). Whilst call for expansion has slowed, the whole pattern has endured as upper domestic costs build up skilled call for. I lined the inventory closing November with a bearish outlook in “House Depot: Emerging Prices And Peaking Call for Would possibly Opposite Features” – HD has declined via round 25% since then.

Personally, House Depot is lately at a important turning level. The spike in loan charges has created rising detrimental force at the housing and development markets. Moreover, declining actual earning have brought about financial savings ranges to fall dramatically, that means other folks can not manage to pay for the similar domestic upgrades they may two years in the past. Sturdy financial alerts such because the yield curve, industry tendencies, and shopper sentiment all level towards a long lasting contraction that started round Q2.

House Depot’s profits and gross sales have in most cases remained strong in spite of those headwinds. Then again, I consider House Depot’s gross sales lag financial knowledge as a result of {most professional} and selfmade upgrades, and development normally, are deliberate months upfront. As such, House Depot’s Q2 knowledge displays the commercial truth of This autumn 2021 to Q1 of 2022 when domestic growth tasks had been deliberate or shriveled for the Q2 time frame. Accordingly, House Depot’s Q3 knowledge would possibly higher mirror transferring financial tendencies, growing the potential of a substantial detrimental profits revision.

Financial Slowdown Hits House Development

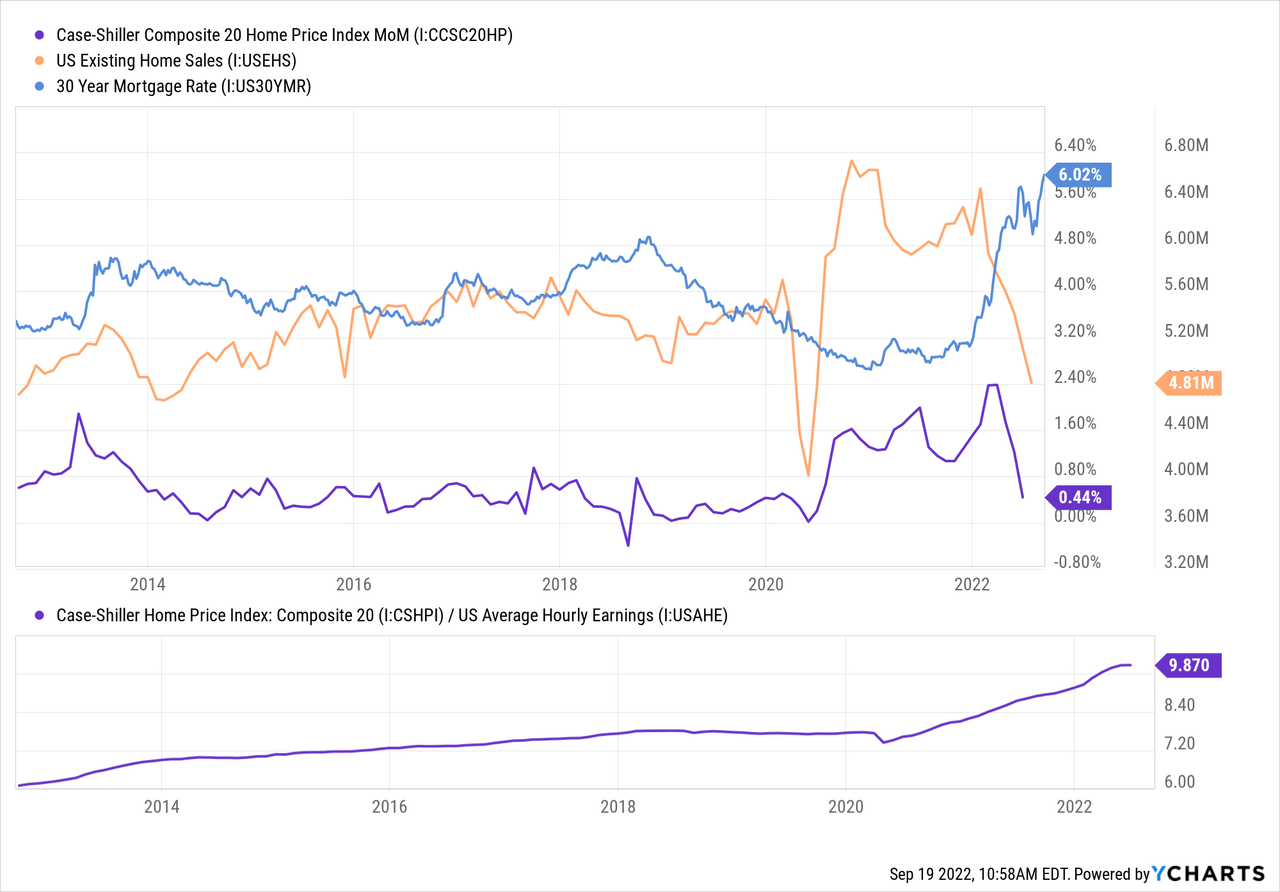

Over fresh years, House Depot has been supported via many financial tendencies. House Flipping and residential growth have, partly, turn into a countrywide pastime following the upward thrust of house-flipping TV displays and types. The selection of domestic dealers advertising flipped houses used to be at multi-decade highs closing quarter, although benefit margins had been down for the 6th consecutive quarter. It must be famous that domestic flipper benefit margins slipped in spite of emerging nationwide actual property costs. I be expecting home-flipping benefit margins to say no all of a sudden as upper loan charges negatively have an effect on domestic fee expansion. See under:

Developments in 2020, similar to Q.E., fueled low loan charges and fueled a growth in domestic costs. The house-price to revenue ratio rose via round 33% as fee ranges had been re-adjusted to decrease passion prices. This yr, the loan charge has risen to the best for the reason that 2000s, triggering a speedy decline in present domestic gross sales. Month-over-month domestic fee expansion remains to be sure however seems very prone to flip detrimental, given its present pattern. The house price-to-income ratio degree is very similar to simply sooner than the 2008 crash, implying that domestic costs may just decline via 20-30% nationally except inflation triggers a extra important salary growth.

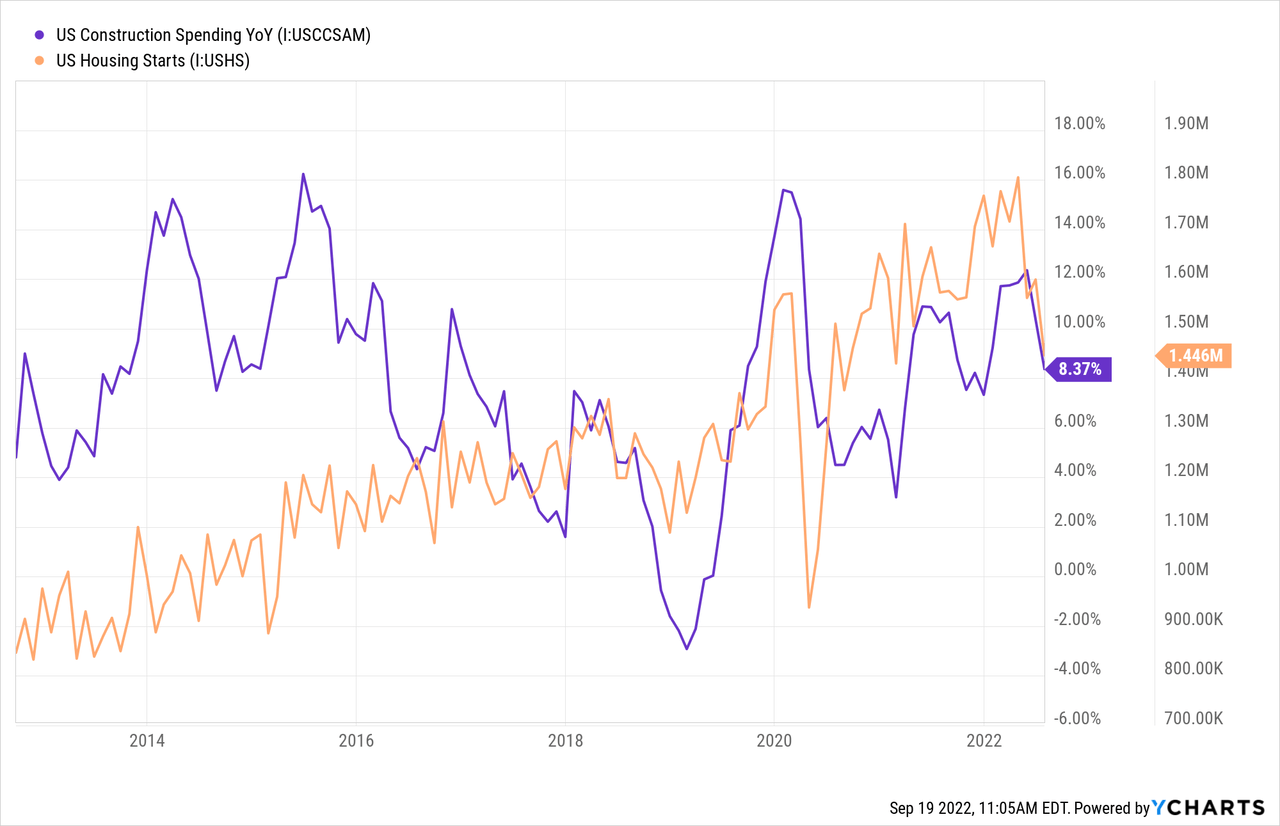

Building spending expansion and housing begins are nonetheless in most cases prime in spite of the detrimental force at the assets marketplace. See under:

House Depot’s gross sales are likelier to be tied to development spending expansion hooked up to housing begins. After all, many huge development contractors don’t seem to be the usage of House Depot as a store. Nonetheless, I consider it’s truthful to think that total development tendencies must relate to small tasks House Depot caters to. Building ranges stay prime as of late however will most likely lag financial actual property tendencies via 3 to eighteen months (relying on mission measurement) since tasks are deliberate properly upfront. In different phrases, a lot of the development spending task as of late used to be deliberate throughout higher financial sessions sooner than loan charges skyrocketed.

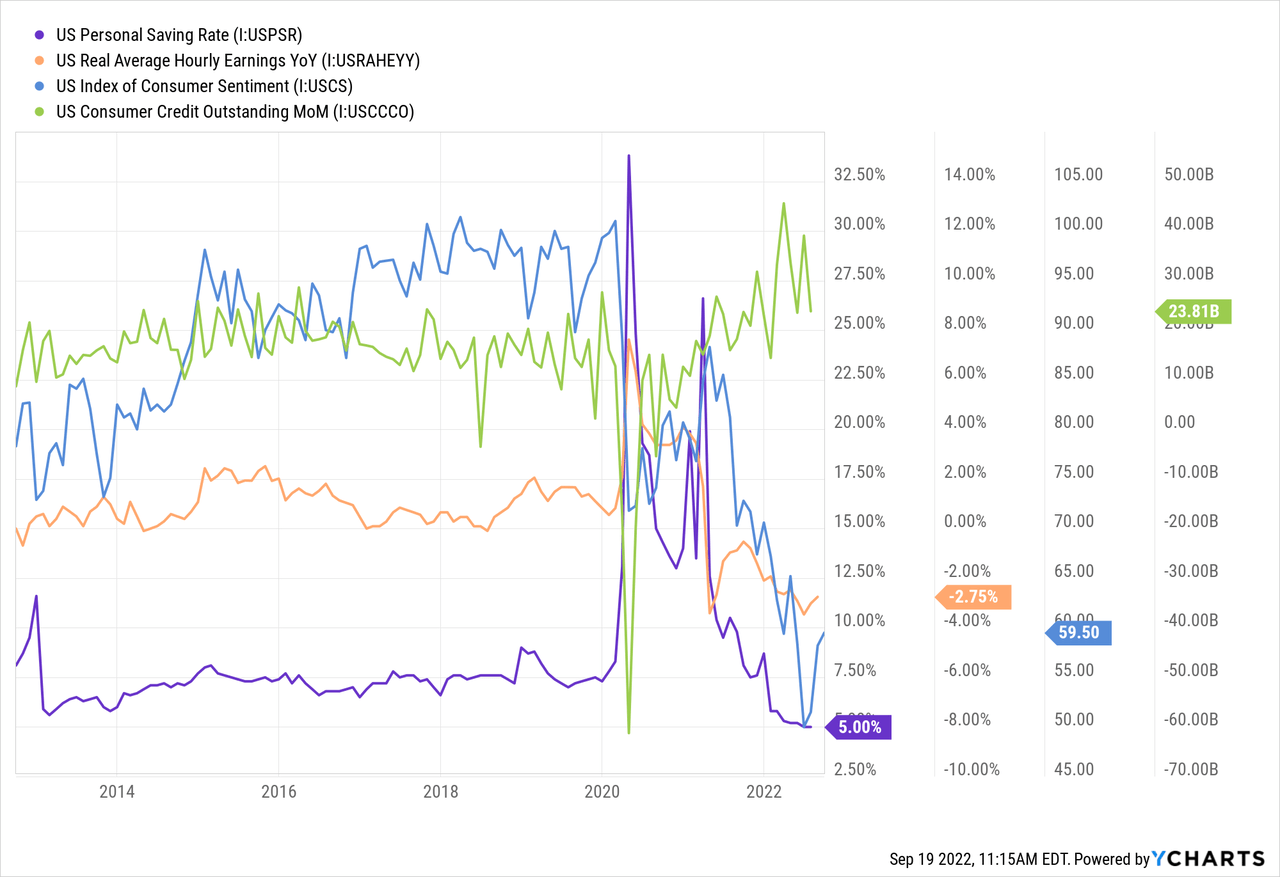

Moving to the DIY marketplace, we are seeing cast alerts of declines in other folks’s talent to finance domestic growth tasks. Sentiment, financial savings, and salary expansion are all shallow. There was some synthetic marketplace make stronger from emerging shopper lending, however this is not likely to proceed to learn the marketplace as bank cards, and different private debt can best be used such a lot. See under:

The considerable upward push in private saving ranges and actual hourly profits throughout 2020 used to be most likely a major factor selling domestic growth gross sales expansion. Many of us had extra financial savings because of diminished spending (holidays, and so forth.) and stimulus assessments. Then again, this pattern has reversed as financial savings is now well-below pre-2020 ranges as inflation reasons actual earning to say no. Upper shopper credit score has supported shopper spending however can not proceed with out spurring a upward push in defaults. Sooner or later, prime family debt expansion will most likely create detrimental force on spending as bankruptcies and defaults must upward push given such speedy debt expansion.

Rising Inventories Sign Liquidity Dangers

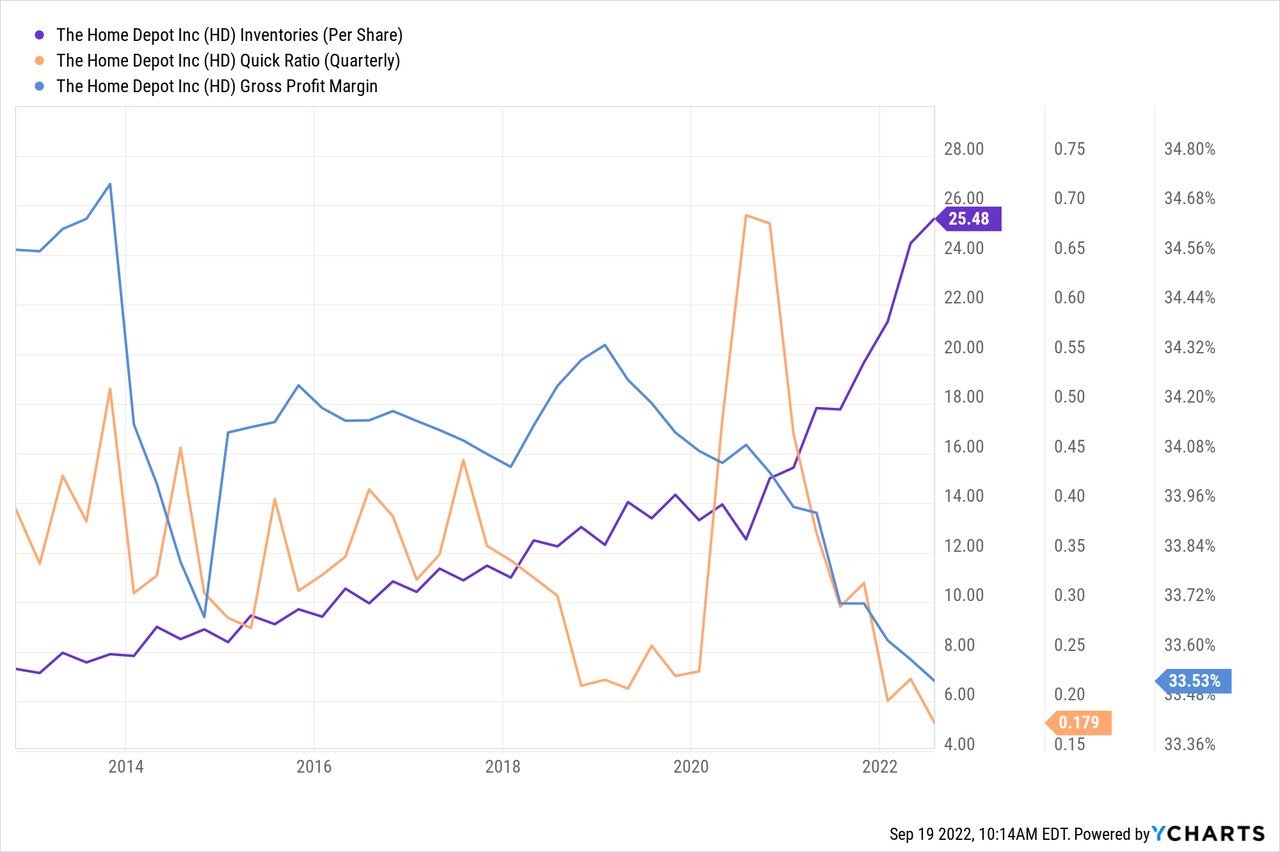

House Depot has noticed super stock expansion during the last two years. That is in part because of emerging costs, that have up to now been handed onto consumers, however signifies some possibility if gross sales decline. Moreover, House Depot’s money ranges are a little low, exacerbating its problem possibility in terms of a slowdown. The corporate’s inventory has declined reasonably as those tendencies have grown, however at a “P/E” valuation of round 17X, I don’t consider those dangers are totally priced into the inventory. See House Depot’s stock, fast ratio, and gross margins under:

All over 2020, there used to be an preliminary surge in House Depot’s fast ratio as the corporate greater money dramatically to cut back lockdown-related dangers. Since then, House Depot’s stock has surged whilst its fast ratio has declined towards excessive lows. Personally, this can be a purple flag as it approach the corporate has few present liquid belongings and should promote stock to satisfy present duties. Assuming the call for for domestic growth and development merchandise stays sturdy, this issue is probably not a subject matter, however financial knowledge alerts call for would possibly most likely weaken.

To this point, House Depot’s gross margins were strong at 33.5% however have trended decrease regularly during the last 3 years. The tempo of declines isn’t lately sufficiently big to negatively have an effect on the company’s final analysis materially. That mentioned, this is a signal the company is having some slight difficulties passing emerging enter prices onto consumers. Assuming a reversal in domestic growth call for, the corporate would possibly promote fewer merchandise at a lower-than-anticipated fee. Given its low fast ratio and prime inventories, that attainable may just create subject matter liquidity dangers for the corporate if extended.

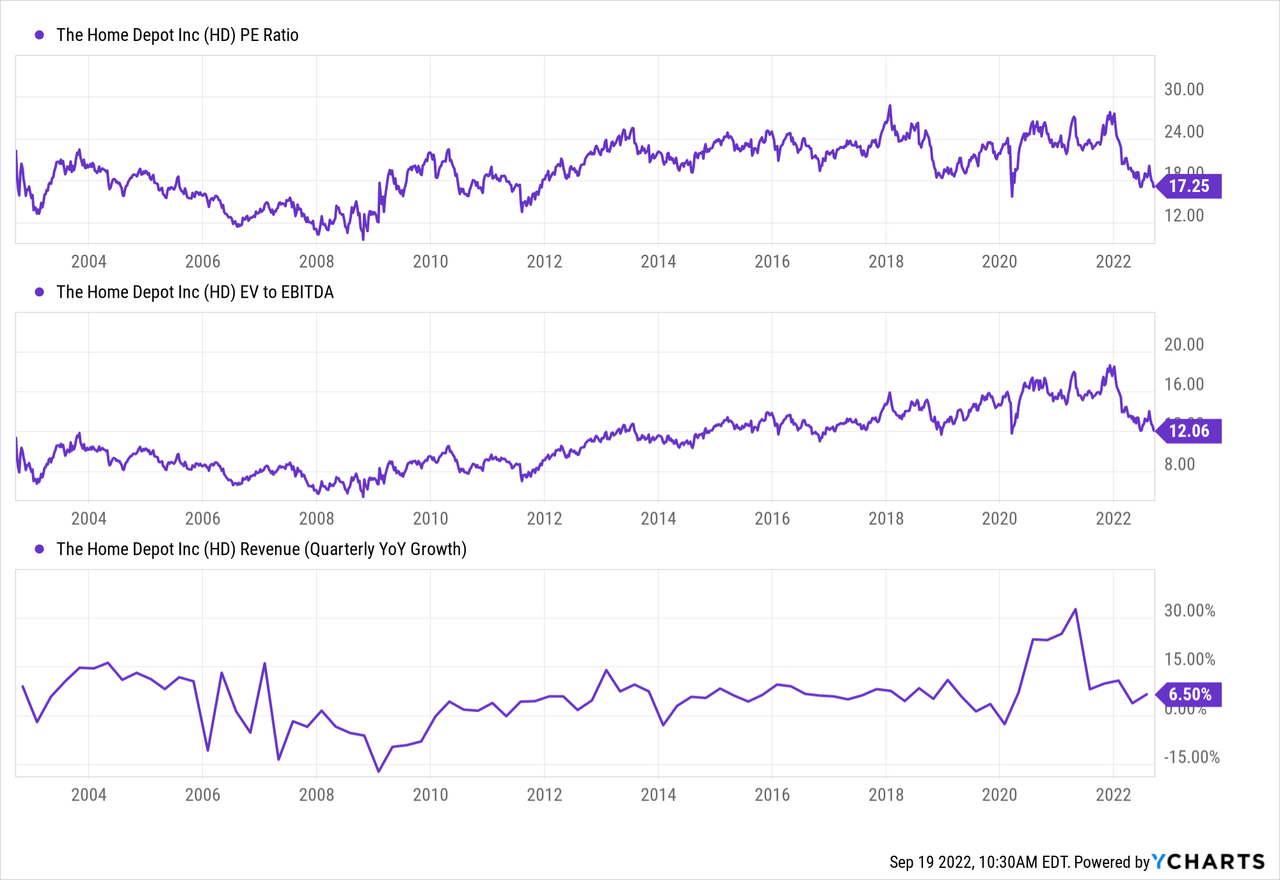

House Depot’s “P/E” and “EV/EBITDA” valuations are towards the low-end in their ten-year vary. At the floor, that knowledge would possibly point out the corporate’s dangers are priced into the inventory. Then again, the company has additionally had stable prime gross sales expansion over many of the previous decade. All over the 2000s, when its gross sales expansion used to be decrease and in part detrimental, House Depot’s valuation used to be more or less 20-40% not up to it’s as of late. See under:

If we think House Depot would possibly face a short lived hiccup and temporarily go back towards a expansion place, the inventory could also be undervalued as of late. Then again, HD would nonetheless be overrated, assuming its secular expansion section is finishing whilst its stability sheet and financial dangers develop. Personally, the latter is a ways much more likely.

House Depot has grown greatly since 2010 as it is absorbed marketplace proportion from smaller native competition. Lately, there are nearly not more last locally-owned domestic growth outlets for House Depot (or Lowe’s (LOW)) to outcompete. Through the years, this must imply House Depot and Lowe’s will wish to turn into extra competitive in price war since they’re not competing with “low economies of scale” companies. Contractors and DIYers will most likely turn into extra conscious about costs as financial pressure grows, specifically if inflation affects development and residential growth items asymmetrically.

The Backside Line

General, I’m bearish on HD and consider the inventory will most likely decline over the approaching months. At the floor, its Q2 profits can have gave the impression extra powerful than anticipated, however this can be as a result of analysts underappreciate the “lag issue” within the development and residential growth business. I consider House Depot’s “power” is essentially tied to tasks to begin with deliberate firstly of the yr when the actual property and shopper markets had been a lot more potent. As such, I be expecting House Depot’s Q3 and This autumn profits to raised mirror as of late’s financial truth.

Given House Depot’s prime stock ranges and coffee fast ratio, I don’t consider it’s properly located for a considerable decline in call for. The corporate’s debt isn’t so prime that I believe it’ll face insolvency, however its stability sheet dangers may just spur some lasting monetary problems, specifically if it turns into more difficult to cross inflation directly to consumers. Additional, I don’t suppose House Depot’s long-term potentialities are sturdy, given it’ll be tougher to develop marketplace proportion (with out sacrificing margins) as aggressive pressures mount.

House Depot is a well-run corporate with a robust monitor document, however even the most productive companies can not conquer sturdy financial headwinds and aggressive pressures. I might no longer wager in opposition to the inventory since its valuation is at a 10-year make stronger degree and may just to find new consumers at this fee. Additionally it is conceivable that call for is restored if inflation pressures decline, however for now, that turns out not likely. That mentioned, I consider its fee would possibly lower via an extra 20-40% to a variety of $170 to $225 as its valuation displays a contracting marketplace dynamic and a decline in its long-term profits expansion outlook.