JHVEPhoto

goeasy (TSX:GSY:CA) (OTCPK:EHMEF) the most important Canadian subprime lender has been an improbable inventory to possess the previous 5 years. The corporate has hit the candy spot between the riskier payday mortgage marketplace and the high main financial institution lenders. The corporate’s major section easyfinancial is a community of retail outlets offering non-public, house fairness and auto loans. This is the point of interest of the corporate the previous 8 years as its easyhome leasing section has most commonly stagnant earnings/profits. Just lately the corporate has moved into the rising level of sale and on-line mortgage house to strengthen expansion. Sturdy mortgage e book expansion, sensible fairness investments and just right control have resulted in vital outperformance in percentage appreciation over that point. It’s been one of the vital best possible appearing shares at the Toronto Inventory Alternate during the last 10 years. The corporate has a cast 2.54% dividend yield with has grown every year for a few years, making it extraordinarily interesting for buyers. The character of its industry in prime possibility subprime lending has stored some establishments at the sidelines, however that has confirmed to be a mistake as the corporate has fired on all cylinders. The corporate just lately reported an overly robust Q2 print at the same time as fears of recession are creeping into the markets.

Q2 Print supplies self assurance longer term

goeasy has a tendency to have an overly strong efficiency quarter to quarter for a small cap inventory, with constant earnings expansion and profitability during the last few years. Earnings expansion was once 24.4% over the prior yr as much as 252 million CAD. The important thing metric that strikes the inventory on a shorter time period foundation are the mortgage originations – new loans the corporate created within the quarter. Q2 was once an enormous quarter for mortgage originations with the most important choice of programs ever for the corporate. The corporate had an especially robust $628 million of originations within the quarter with mortgage expansion of $216m after accounting for loans that ran off. After the quarter the corporate has loans proudly owning of two.37 billion CAD, appearing how robust originations are nowadays. A part of this power is because of corporate explicit elements reminiscent of the brand new auto mortgage product, which control known as out because it was once $50 million within the quarter up 450% over remaining yr. Additionally they noticed power from house fairness loans up 169% over remaining yr. Those house fairness loans are secured at the worth of the house, which lowers the chance for GSY. This is likely one of the elements permitting goeasy to scale back its web rate off fee from 13% a couple of years ago to a spread of 9-10% now. This implies a smaller provision for mortgage losses is needed, and more cash to the base line with document running source of revenue of $85 million or 35.3% running margin. The disadvantage of a decrease yield from those higher appearing loans is negated via the larger credit score high quality and steadiness it supplies the industry longer term.

Every other issue for power in loans within the subprime client are the hot problems with inflation squeezing decrease finish shoppers. This implies extra other people would possibly want to take out a mortgage to consolidate debt or meet massive fee duties. GSY discussed how powersports and residential development call for have been robust, hurting the upcoming recession concept talked of past due. Those are discretionary purchases that any person that has had a chapter would possibly want to flip to GSY for in the event that they can’t lend from the key Canadian banks. The corporate additionally famous at the Q2 convention name that the massive 5 Canadian banks lending necessities had been getting tighter, pushing some low finish consumers down from the key banks to goeasy. The document choice of consumers this quarter turns out to indicate this can be a issue at play. This tailwind will have to lend a hand going ahead as inflation is not likely to hamper quickly and bills will most likely keep tight within the decrease finish of the source of revenue spectrum the place GSY has consumers.

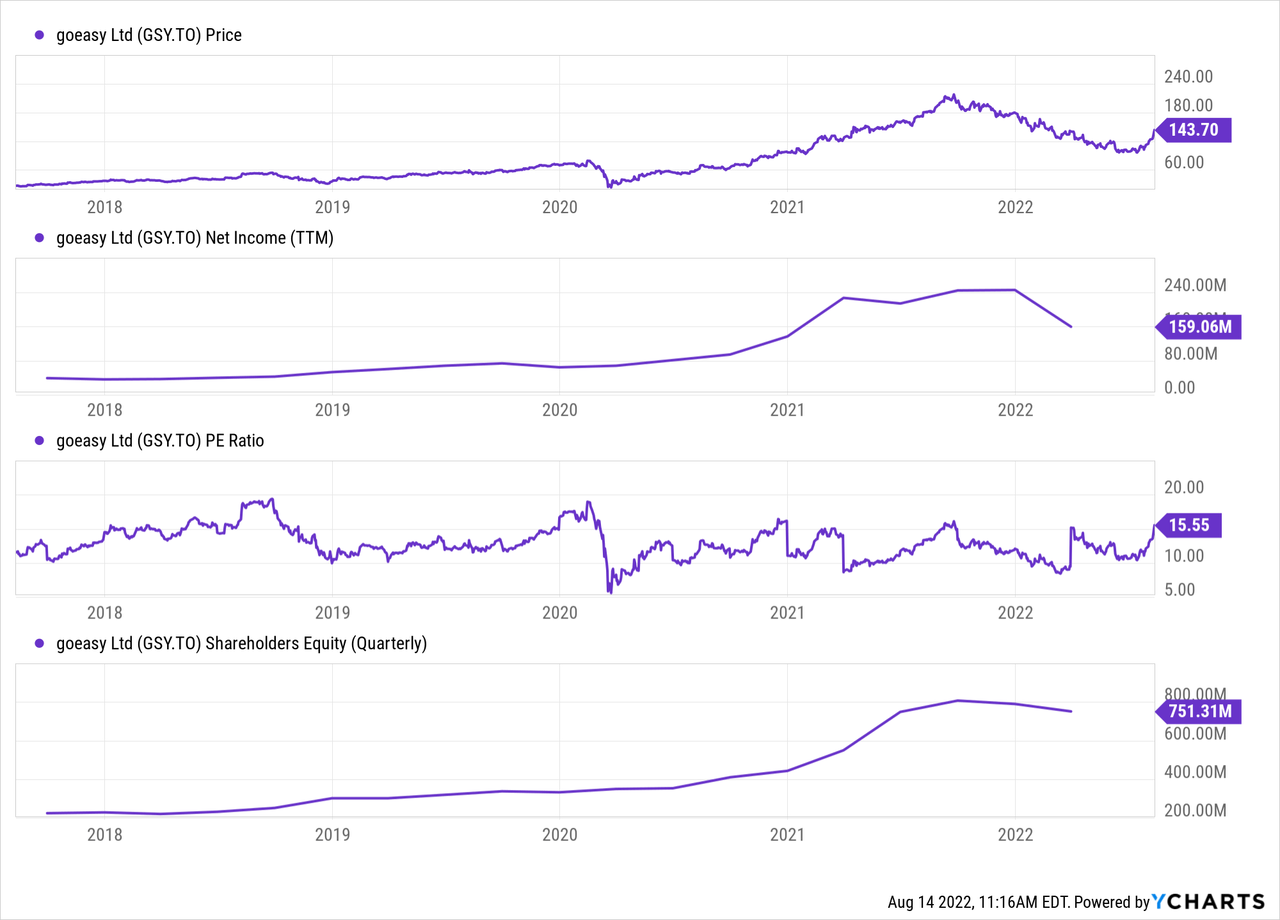

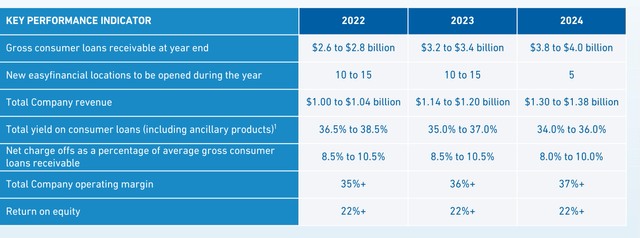

As you’ll see above the corporate is if truth be told less expensive on a worth to profits foundation than it was once previous to Covid-19 in past due 2019 and mid 2018. On the other hand, the corporate continues to be benefitting from a decrease unhealthy mortgage fee and better expansion fee. Truthful worth of the stocks most likely lies within the prime 100 buck vary with a cast 10-20% percentage upside every yr with robust efficiency. Understand that as the corporate has robust originations, GAAP web source of revenue is decreased within the quick time period via larger mortgage loss provisions with that source of revenue made up in long run quarters when the loans are repaid. You’ll see this within the above chart with the relief in TTM web source of revenue to $159 million. Nonetheless the corporate trades at simply 15x trailing P/E just a little upper than the 5 yr reasonable. The corporate expects to just about double its mortgage e book via the tip of 2024 to round $4 billion Canadian, which might imply vital expansion nonetheless to come back. That is with a reasonable addition of 20-35 places over the following two and a part years, appearing it’s most commonly coming from potency of their present places. This is helping result in that upper corporate running margin even with 2% decrease yield on client loans. The larger advantage of its on-line mortgage choices is helping build up running margin through the years, as the corporate advantages from scale.

Efficiency Signs (GSY Q2 presentation)

Canada Drives funding

goeasy made a big acquisition remaining yr with its LendCare acquire to present itself a robust foothold within the automobile mortgage and gear recreation area. They paid $320 million for the industry, obtaining $404 million in loans to strengthen expansion. LendCare has been a large asset for them previously yr with a most commonly secured portfolio, with a decrease rate of interest serving to decrease rate offs and unhealthy debt. This house gave a brand new vertical to lend for goeasy serving to energy the following leg of expansion whilst making improvements to credit score high quality. They only made a 40 million CAD funding in Canada Drives, the most important on-line automotive buying groceries and supply platform in Canada. Non high consumers of Canada Drives will be capable of get loans via GSY, serving to expansion on this house. Over 100,000 consumers had been despatched from Canada Drives through the years, and the strengthening of that partnership is a huge get advantages. GSY has additionally been very a success in identical investments previously, with a $34.3 million funding in Paybright in September 2019 changing into an enormous achieve in Confirm (AFRM) stocks when it were given received. The achieve made in this acquire as of nowadays is 3.2 occasions the unique funding, or an outstanding 109 million CAD achieve as of August 2022. Those shrewd strikes lend a hand give self assurance that the corporate will be capable of maintain 15%+ earnings and profits expansion even because the mortgage e book turns into much less dangerous.

Chance elements

The marketplace sees dangers reminiscent of a possible invoice to decrease the criminal rate of interest in Canada as not likely. Expenses reminiscent of this had been put ahead in the home of commons in Canada previously, however by no means received sufficient traction to transport ahead towards a vote. Explanation why being as posited via CEO Jason Mullins, that doing so if truth be told pushes shoppers to objects reminiscent of payday loans which do not lend a hand rebuild credit score. To give protection to by contrast not likely chance, the corporate has been lowering its combined rate of interest with the expanding use of the secured loans offsetting this doable possibility to a point.

Recessionary dangers because of the subprime client was once most commonly disproved all over the Covid-19 pandemic. Many purchasers are seeking to rebuild credit score ratings, and thus take mortgage coverage which prevents rate offs in deficient financial occasions. Additionally, lots of the consumers with unsecured loans do not personal their very own houses, which means much less difficulties paying loans than those that finally end up in hassle with a loan. This stays the most important possibility to the inventory, with the inventory appearing relatively somewhat of volatility all over the Covid-19 March 2020 surprise. The inventory went from $79 to a low of $20 with out a deterioration of basics. Consider identical shocks are a possibility sooner or later, as a moderately thinly traded small cap inventory with perceived possibility all over recession.

Conclusion – A will have to personal Canadian inventory

The praise for goeasy has some distance outweighed the chance for the previous choice of years and the corporate has dramatically de-risked its profile through the years. Some keep away from the inventory because of its belief as moderately of a ‘sin’ inventory or that it is going to fall aside in a recession. On the other hand those unfounded fears simply imply larger shareholder returns for people that make investments. The corporate is powerful with an expanding on-line presence, making improvements to emblem identify and bold go back on fairness. I extremely suggest American buyers to try this identify, because it does industry OTC beneath the ticker EHMEF. Consider if you are going to buy in USD that liquidity and quantity might be relatively low and to make use of prohibit orders to reasonable into the identify. It has some distance outperformed its American friends within the area, with Canadian low finish shoppers showing a awesome possibility/go back profile. The corporate will keep growing for years yet to come, with dividends as well making it an overly attractive monetary for any portfolio.