During the last century, world lifestyles expectancy has higher by way of greater than 25 years, and it continues to beef up. Don’t get stuck off guard by way of outliving your cash since you idea you can by no means reside to 80, 90 and even 100, writes Wynand Gouws.

Don’t get stuck off guard by way of outliving your cash since you idea you can by no means reside to 80, 90 and even 100.

When making plans in your retirement, it is very important to take into accounts how lengthy you and your partner or spouse might reside.

Your highest start line is the historical past of longevity in members of the family – for each you and any spouse. Then imagine your well being and way of life. In case your circle of relatives has a historical past of longevity – in case your folks and grandparents lived lengthy and wholesome lives – there’s a prime likelihood that you may additionally reside a protracted and wholesome lifestyles.

Nobody can plan precisely how lengthy they are going to reside, as many stuff in our lives are outdoor our regulate. Alternatively, statistics display that persons are in most cases residing longer nowadays than up to now. This can also be attributed to persisted developments in era and inventions within the box of scientific remedy.

Expanding longevity

During the last century, world lifestyles expectancy has higher by way of greater than 25 years, and it continues to beef up.

The Stanford Centre on Longevity just lately said: “By means of the center of this century, residing to the age of 100 will grow to be common, proceeding a exceptional pattern that noticed human lifestyles expectations double between 1900 and 2000, expanding extra in one century than throughout all prior millennia of human evolution blended.”

Aubrey de Gray, a British biomedical gerontologist residing in the USA, believes that the primary particular person to reside to 150 has already been born.

Although those feedback are in line with the truth in evolved nations, longevity could also be a fact for you and me, residing in South Africa, in step with native mortality statistics.

Moderate retirement round twenty years

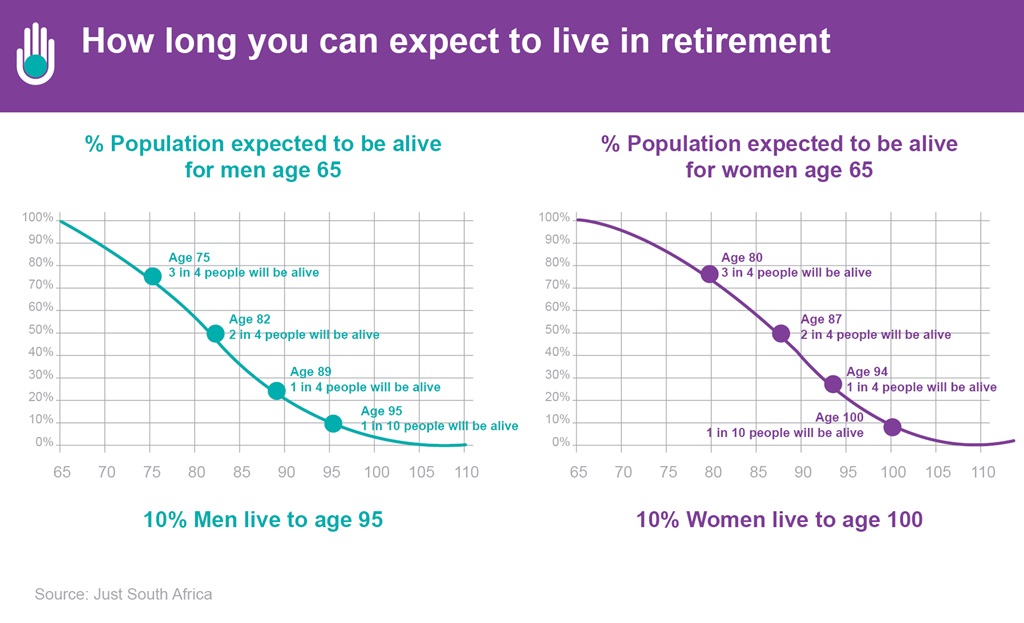

In response to South African mortality statistics (expectancies on how lengthy we will be able to reside) you will need to plan for residing into your 90s and 100s. A person elderly 65 is anticipated to continue to exist moderate to age 82, whilst a girl elderly 65 is anticipated to continue to exist moderate to age 87.

It’s also necessary to needless to say those are the averages, and many people will outlive this moderate lifestyles expectancy. For instance, 25% of guys elderly 65 will reside to 89 and 10% will reside to 95 and past. Round 25% of girls will reside to 94 and 10% will reside to 100 and past.

If you’re a pair elderly 65 there’s a prime likelihood that certainly one of you’ll reside into your mid 90’s and past, in step with mortality knowledge from retirement product supplier Simply South Africa.

Difficult retirement age

This persisted building up in lifestyles expectancy is profound and will have to have an important have an effect on on how we take into accounts lifestyles and retirement making plans.

It additionally demanding situations the normal knowledge that we will have to retire between the age 55 or 65.

We wish to reconsider the standard idea of retirement being a “line within the sand” at between 55 or 65.

As a substitute we will have to reframe our considering to imagine beginning our subsequent lifestyles chapters at 55, 60 or 65, and to plot for more than one chapters in your lifestyles to 100.

Have a good time if in case you have a plan

The United Countries describes inhabitants getting older and higher longevity as a “human good fortune tale” that provides us a explanation why to have a good time public well being, scientific developments, and financial and social building.

Inhabitants getting older has been recognised as one of the crucial 4 world demographic megatrends, subsequent to inhabitants enlargement, world migration, and urbanisation, which may have a long-lasting have an effect on on sustainable building.

Longevity is also one thing we will be able to have a good time if we will be able to deal with demanding situations that include it. Considered one of them is financing it.

Have a good time which you can reside so much longer that you just deliberate for! But in addition take into accout monetary safety begins with a legitimate plan in your Existence to 100.

This newsletter used to be first revealed on SmartAboutMoney.co.za, an initiative by way of the Affiliation for Financial savings and Funding South Africa (ASISA).